Last weekend, Portfolio also reported that a regulated real estate investment pre-company Latvian from the Appenines. After that, the stock rose more than 17 percent on Monday, and the rally will continue on Tuesday with strong trading, so it is no exaggeration to say that Hungarian investors are going crazy for the stock. We take a look at what you need to know about the new star of the Hungarian stock market and why the transformation is capturing investors' imagination.

Appeninn transformed into SZIT

Appeninn's General Assembly still December decided to become a SZIT, following which the Company Court of the Metropolitan Court of Budapest registered Appeninn as a regulated real estate investment pre-company in the Commercial Register on 14 January.

However, the transformation into an SZIT was preceded by a lengthy process: the company's board of directors decided in 2022 to put the group's operations on a new strategic footing. As part of this transformation, the company's former CEO, Tamás Bihari, resigned in August 2022 and was replaced by Tamás Bihari, who had previously served as the company's Chief Financial and Operating Officer. Györgyi Szűcs took over.

"An important element of the transformation has been the sale of the company's development projects and the strengthening of the structure of the real estate portfolio through new acquisitions. The most striking market feedback on the success of the strategy change was the upgrade of Scope Ratings in April, but it is also reflected in our half-year figures this year: our first six months' revenue of around EUR 9.1 million was double last year's, and our half-year operating profit, excluding revaluation effects, reached EUR 4.7 million," said Györgyi Szűcs, CEO of the company. to our magazine.

Why is it important to become an SZIT?

The announcement is also a trigger for investors' imagination, as the company is expected to pay a substantial dividend soon, as a regulated real estate investment trust (REIT) or a pre-investment company (PEI), the board of directors is required by the relevant legislation to propose to the general meeting of shareholders the payment of a dividend at least equal to the expected dividend each year. This is 90% of the annual profit for the year from the registration of the SZIT/SZIE until its deregistration.

When analysing the figures, it is also worth noting that the consolidated figures of the group are always published on an IFRS basis, in euros, so there is always an operating profit and a profit due to the change in the euro exchange rate and the value of real estate. This is also an important aspect because, as a SZIT or SZIE, Appeninn and its project companies will be required to revalue their real estate on a quarterly basis.

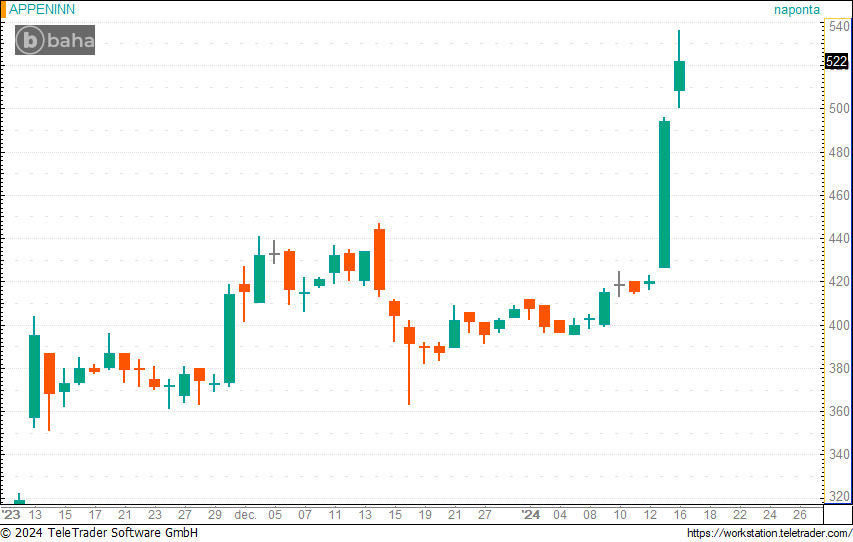

Nearly 25 percent rally in just 2 days

On Tuesday afternoon, Appeninn's shares were already up 5.7 percent, but a few minutes ago they were already up 8.5 percent, while the stock has risen nearly 25 percent since the weekend announcement.

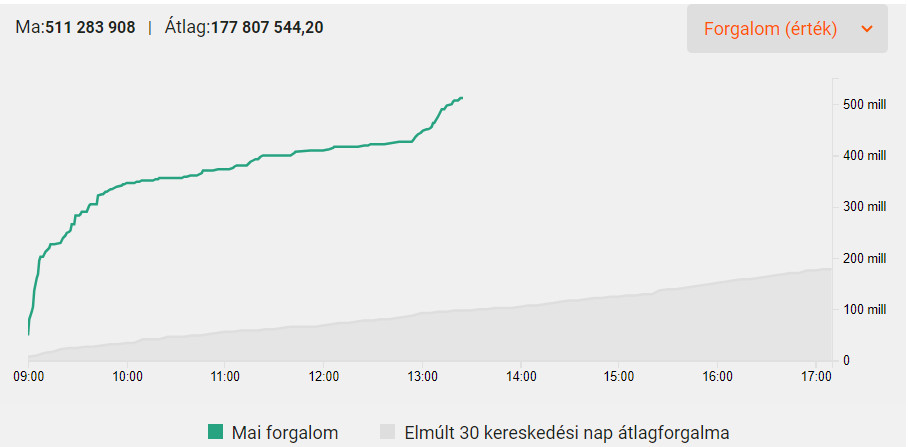

Turnover has also been outstanding today, with more than half a billion forints exchanging hands, making Appeninn the third most traded stock on the BSE today after OTP and Magyar Telekom.

The exchange rate has not been this high for a long time

And with the current rise, it's up to

Paper has rallied to levels not seen since May 2019.

In addition, with the recent increase, the company's market capitalisation has reached HUF 23.4 billion.

Cover image source: portfolio