Even after the rallies of recent months, the real estate investor's shares do not seem overvalued.

Little market impact from the Appeninn's recent general assembly, where personnel issues were decided. All the more exciting in mid-January was that nearly 20 percent in a single day rallied in the Share on the news that the company has entered the regulated the front room of real estate investment trusts (REITs) as a regulated real estate investment holding company.

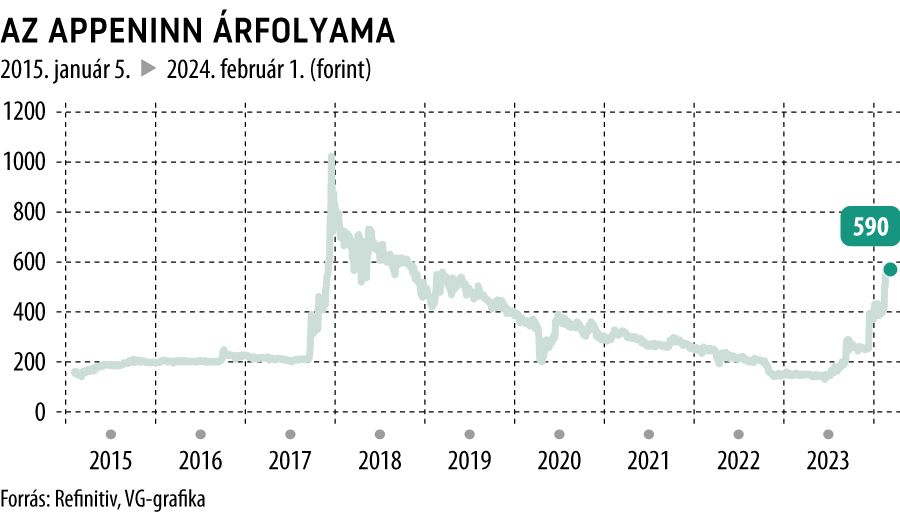

Appeninn was already on a roll last fall. In November, the invitation to the December general meeting was published at 257 forints, and the share price was already at 425 forints when shareholders voted in favour of the SZIT initiate a divorce. Looking back from the current high of 590 forints, we see that the exchange rate has more than doubled in less than three months.

The last time Appeninn showed such steep price dynamics was when the Konzum Group and BDPST Group has temporarily joined the company and has set the strategic goal of becoming the largest real estate investor with the highest growth potential in the region within a short period of time.

Now SZIT is the focal point.

Companies operating in this way benefit from a number of tax advantages, such as exemption from corporate tax. Tax and local business tax. In addition, they pay a reduced 2 per cent reversionary property transfer tax on the acquisition of ownership of immovable property, rights in rem and shares in a company with domestic immovable property. And in the case of a transaction between related parties, the transaction is exempt from duty. But the crux of the matter lies in the rules on the payment of dividends, since the management of the SZIT, or the board of directors in the case of a joint stock company, must propose the payment of at least 90 percent of the profits as an expected dividend after the annual accounts have been approved.

Appeninn has come a long way in recent years. It's very interesting to have a clean holding structure, but perhaps the most important thing is to clean up the portfolio. After selling the hotels, have moved into offices and commercial property.

The undervaluation of paper is striking. Last summer, at price levels close to 200 forints at the time, on a P/BV basis, the Hungarian Premium share leader was Appeninn with an indicator of 0.25. But even at the current price level of 590 forints, it is still considered very cheap. As a prospective SZIT security, it promises a strong dividend yield in the future.